From European Tax-Portal steuerratschlag.eu – It started as the „most ambitious“ crypto project of all time, now its investors are facing ruin: DavorCoin. The scam was extremely tricky. With a newly issued, almost worthless cryptocurrency, the Davor, the operators probably captured several thousand Bitcoins worth up to US$ 300 million. Davor lured investors with monthly returns of up to 48 percent. For many investors from the USA, UK, France, Germany, Swiss, Austria, Japan, Australia, Russia or Asia, the advertising slogan on the Davor website is just a bad joke: „The most ambitious cryptocurrency projects“ is the promising claim of the platform operators. Meanwhile, it is clear: they were only part of a million fraud. Instead of fantastic returns, many investors now have to accept the total loss of their invested capital (steuerratschlag.eu reported in Part 1 and Part 2 about this Millionen Fraud).

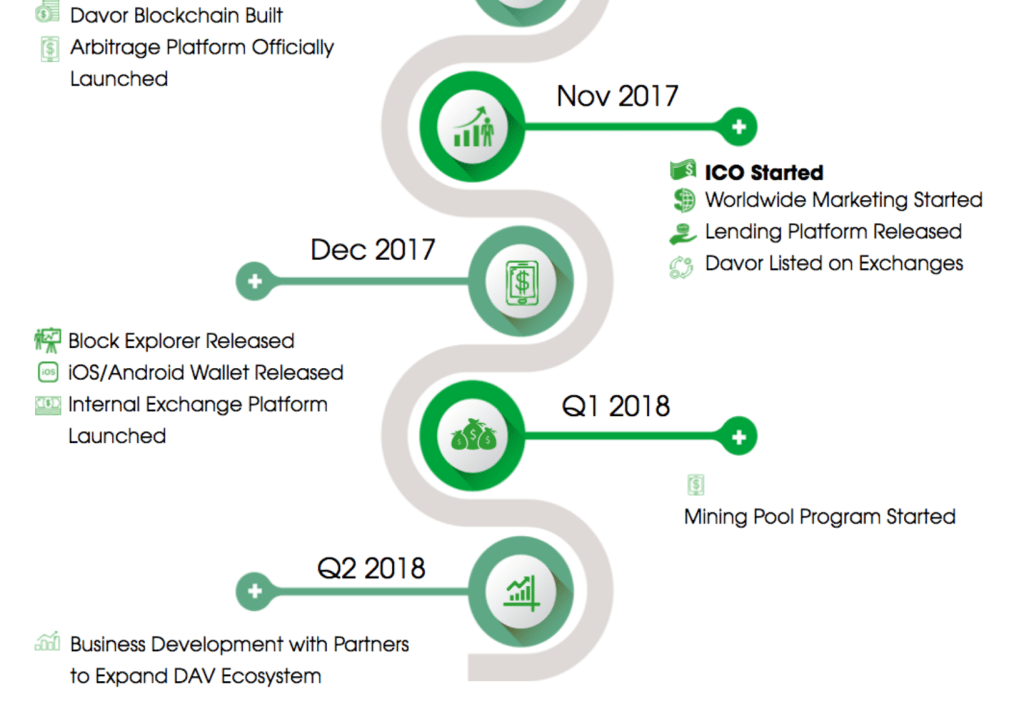

Davor Coin was conceived as a platform for the lending and trading of cryptocurrencies. The service started just a few weeks ago, on 6 November 2017. For the operation, the makers issued their own token called Davor Coin (DAV).

At first, the project was extremely promising, especially when you take a look into the white paper, where the Davor Coin is advertised in flowery words and chic graphics – a classic repertoire of the scam scene (Download the Davor Coin „whitepaper“: WP_DavorCoin_1.1)

Davor Coin benefited from the crypto hype

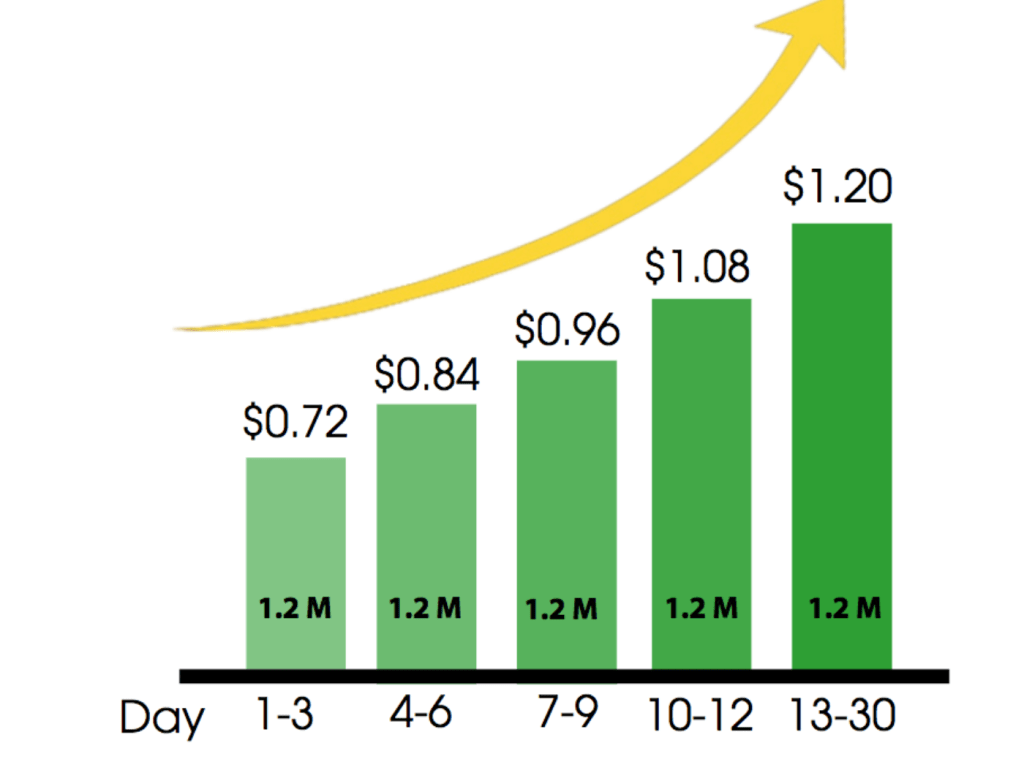

The Initial Coin Offering, a kind of IPO for cryptocurrency, has been very successful. A token cost between 0.72 and 1.20 US dollars, depending on the time of entry. In mid-December 2017, the price went up to US$ 23, breaking through the US$ 50 mark by the end of 2017. The DAV reached its highest level on January 15, 2018 with a value of about US$ 176.

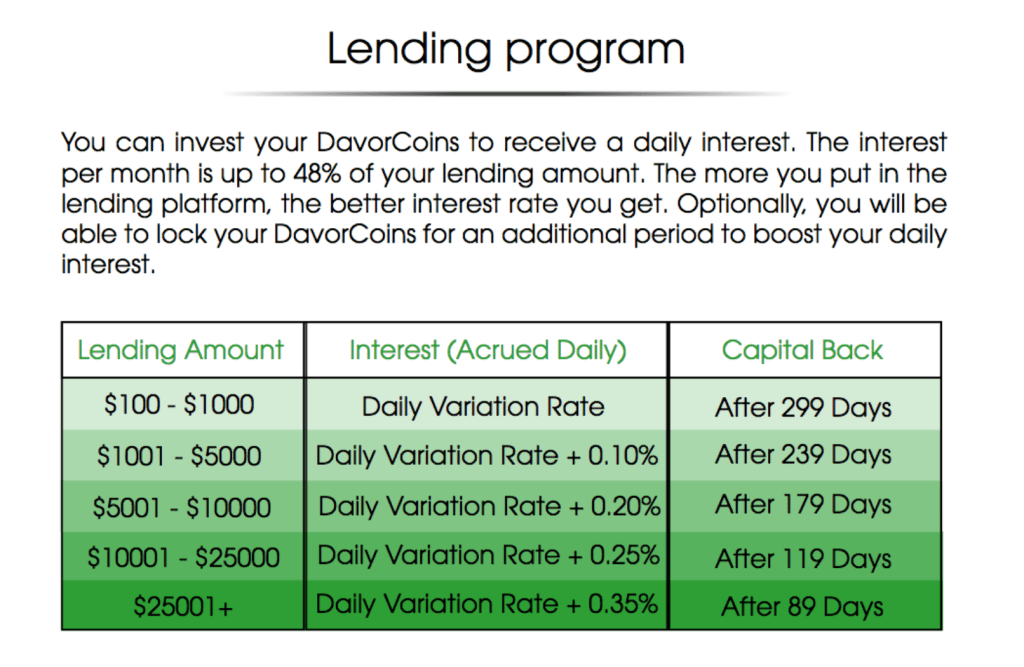

The huge price jumps can be explained with the general crypto boom, which found its high point at the turn of the year. Investors were not only able to achieve a return through the enormous price gains. A comprehensive lending system should also help platform users to make a fortune. The borrower: the platform itself.

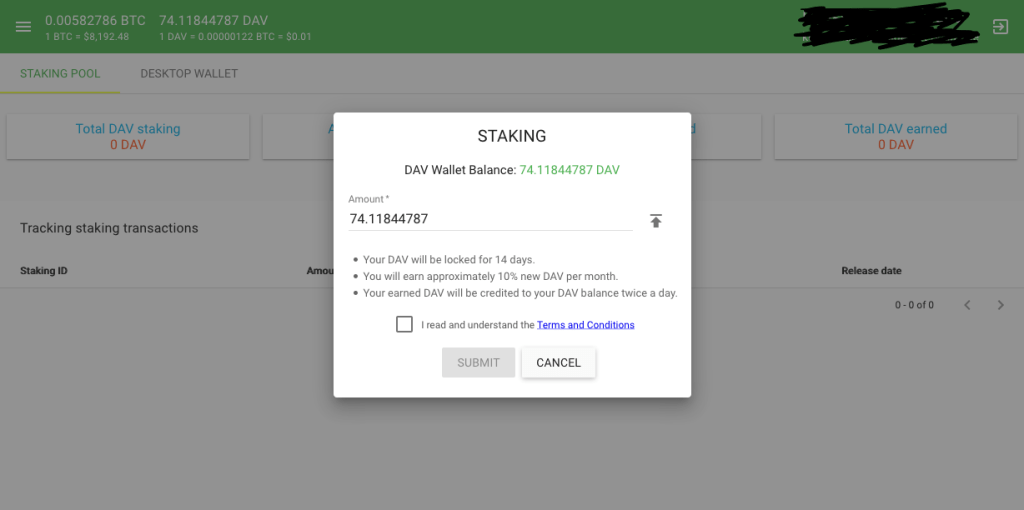

The operators promised daily interest payments of up to two percent and more. For this, the investor had to pay only a sum of at least US$ 1,000 in DAV and leave it there for a certain minimum term. The longer the investment period and the higher the invested amount, the higher the return. However, only Bitcoin could be deposited on the platform, which then had to be exchanged for DAV. A direct deposit or a deposit in dollars or euros was not possible.

A so-called „Profit Calculator“ provided investors with astronomical returns: With a loan of $ 43,000, investors could hope for $ 800 daily. After a minimum term of 200 days, they even received up to 160,000 US dollars in interests and a refund of the capital. The high returns would be generated mainly by crypto-trading bots, according to the operators, who made profits from the price fluctuations on the crypto market. [2]

That’s why people invested into Davor Coin

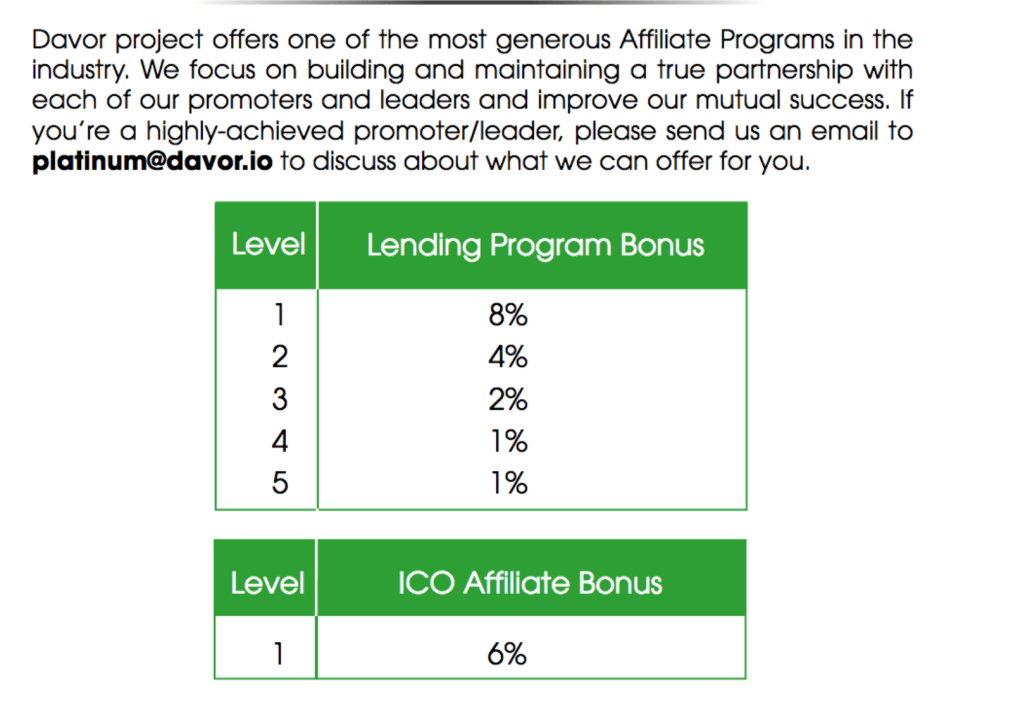

Critics suspect, however, that behind Davor Coin is a kind of snowball system. The money of new customers would be used to pay out the promised returns to the existing customer base. An indication of this is also the comprehensive referral system of Davor Coin. If a new customer lends fresh capital to the platform, the referrer receives 8 percent of the sum credited. With 2 to 3 recommendations, one could earn thousands of dollars additionally.

The promises of the operators sounded almost too good to be true. Nonetheless, many investors worldwide, including those from Germany, Switzerland, Austria, Asia or the US, invested in the program, completely ignoring the risks of total loss and underestimating the criminal energy of the previous Coin makers. The reasons for this are obvious: on the one hand, the crypto market experienced a one-time boom in 2017. Popular cryptocurrencies, such as Bitcoin, Rippel and Co., have seen price gains of 2,000 percent and more.

The media launched stories about Bitcoin millionaires and awesome profits. Everyone wanted a piece of the cake. Since even cryptocurrencies posted daily price gains of 12, 15 or 20 percent, even 2 percent return per day seemed feasible.

On the other hand, the competition did great: Bitconnect, the largest rental platform for cryptocurrencies so far, has been running for over a year. Her own token, the Bitconnect Coin, was worth $ 463 in December. Experts also suspected a pyramid scheme here, but the prospect of huge profits kept many investors in line.

Davor Coin worked with Cloudflare and Google

For Davor Coin also spoke the tidy, stable website and the easy-to-use platform. For added protection, the operators relied on Cloudfare, an internationally recognized US company that protects websites from DDOS attacks, and a „2-Factor authentication“ with Google app. Furthermore, the operators at GitHub, a kind of developer forum, provided the open-source code of Davor Coin, thus creating more transparency. [3]

And Google also prominently allowed advertisements on its sites via its Google Adwords platform advertising system, as recently noted by steuerratschlag.eu. That means: Google also earned. Investors who are fooled by DavorCoin complain that even after the millions of frauds have been announced, Google is offering the DavorCoin app for Android in the Google Play store, and will continue to run Google advertising for DavorCoin through its advertising platform. [4]

The numerous partnerships with large companies such as Google, GitHub and Cloudflare encouraged many users the impression that Davor would have to be a reputable platform, although an imprint and detailed information about the backers of the page was missing – which in the market of coins nothing unusual is.

3 theses: Why did the Davor Coin fall?

The end of the investment platform came as a surprise to many investors. Within a short time, the Davor Coin rapidly lost value. If one unit of the cryptocurrency cost $ 145 on 16 January, the cryptocurrency was sometimes only 5 cents at the beginning of February. Why the price fell so fast is a mystery to many investors. Crypto experts, however, assume 3 scenarios that could have led to the price collapse.

Thesis 1: Bitconnect bankruptcy led to loss of confidence in Davor Coin

On January 16, Bitconnect announced it would stop its rental platform. At the same time began the big sales. Many investors wanted to withdraw their investments from the platform as quickly as possible to save their money. Millions of Bitconnect Coins (BCC), the in-house tokens of the Bitconnect platform, now wanted to be exchanged for Bitcoin. As a result, the BCC fell from $ 240 to $ 25 in one day.

The Bitconnect bankruptcy did not leave its mark on Davor Coin either. The reason: Both platforms work on the same principle, promising high returns on lent money. The mistrust grew over the Davor Coin and many customers now tried to withdraw their capital also from the Davor platform. This thesis is also reinforced by the strong before-price slide from $ 145 to $ 77, shortly after Bitconnect announced its withdrawal from the rental business.

Although recovered before the Davor Coin a short time later and was on 19 January again 130 US dollars worth, but then there was no stopping. Since January 20, almost the course halved on a daily basis. On February 7, the price was just 4 cents. The confidence of investors was apparently gone.

Thesis 2: Mismanagement brought the system „Davor“ to collapse

In the course of the Bitconnect bankruptcy, the Davor-makers made some risky and ill-considered decisions. To regain the trust of the customer base, the company allowed on 25 January 2018 all users to withdraw their lending money before the expiration of the originally agreed investment period again. Investors thus lost the only security that could have been given before: the deposits of many other investors with a minimum term of between 3 and 10 months. [6]

Many crypto investors were already nervous at the time. In addition to the Bitconnect bankruptcy, nearly all crypto currencies lost massive value at the end of January. In addition, the US regulator Texas State Securities Board initiated a writ of warning against Davor Coin for violating US laws with its opaque business practices and anonymous backers. Specifically, in a statement issued on 3 February 2018, the agency accuses the previous operators of promising their investors unrealistically high interest rates that could never be serviced in the long term; one could also speak of consumer delusion. [7]

The difficult market environment and imminent warnings led to a massive sell-off to Davor Coins. Many investors realized that without collateral, the platform can not last much longer. Fearing to lose all their capital, many investors took advantage of the option and dissolved their loans to Davor. As a result, there was again a massive oversupply of Davor Coins, so that the price on the internal stock exchange in the basement sank. The platform operators could also get cold feet in the face of the warning system and have planned their withdrawal from the business. However, since one could not repay the loans, the scenario could also have run: It brought the Davor Coin deliberately to collapse in order to pay investors only cent amounts.

Thesis 3: Davor Coin was designed from the beginning as a scam

There are many indications that Davor Coin was planned from the start as a fraud in order to get millions of Bitcoins in the shortest possible time. In particular, after the announcement of the Bitconnect bankruptcy, many users reported that payment problems arose. Many investors were prevented from creating a sell order. Others report that they could only trade low contingents of DAV.

USD dollar amounts can not be paid directly to Davor. Rather, the customer must complete an annoying odyssey on transactions in order to get his distributed interest income. So you have to convert the interest in US dollars first in DAV. Subsequently, the DAV can be traded on the internal stock exchange against Bitcoin. By transferring the Bitcoins can now transfer to Bitcoin.de or another exchange, where a sale in euros or US dollars in a bank account is possible. However, under the pretext of a technical malfunction, the platform often suspended the exchange of Davor in Bitcoin. German customers reported steuerratschlag.eu, they were so stuck on their Davor Coins, which lost almost every hour in value.

Probably the backers tried to keep the price up artificially, because the fewer coins on the market, the greater the demand. In addition, the sellers could not undercut the price. A further decline in prices would at least be stopped in theory.

Surprisingly, the course continued to fall. Although many private investors were no longer able to trade their Davor Coins, the mountain of available DAVs continued to grow. Presumably, the backers took advantage of the hour to plan the final exit from their business. The exit scenario could have looked like this: While it was no longer possible for private investors to stop selling orders, the Davor operators tossed their coins on the market to still one or the other Bitcoin set aside and earn many millions of euros.

Most likely, the platform operators had already withdrawn a large part of the previously paid up Bitcoins from the market and transferred to their own accounts. With prices around 5 cents for a Davor Coin it would have been easy to push the course back up.

For an equivalent of about $ 50,000, which would currently correspond to about six bitcoins, you could have already bought 1 million Davor Coins. With about 10 million Davor Coins in circulation, it would have come so quickly to a price increase. Presumably, the big bitcoin sums had long since been deducted from the platform, so that the operators could not counteract or even no longer wanted.

How Davor gambled his investors off

Probably the biggest shock for Davor Coin owners came via e-mail. On Feb. 7, 2018, the bankruptcy statement of the company fluttered into the virtual mailboxes of the unsuspecting investors, under the subject „Important Announcement about the Davor Project“. From now on, according to the e-mail, all lent money had been returned, since one can no longer offer the lending option due to current market developments.

The astonishment was great when you then dialed into his account. In fact, only as many pre-coins were credited as one initially deposited in his loan package. For example, a Davor victim known to the editors had loaned $ 43,000 to the platform on January 14, 2018. At the time of the lending, the Davor was $ 147.80. Altogether, the person provided 290.93 coins with a total value of $ 43,000 to the platform, which he had to transfer to Bitcoins at the beginning.

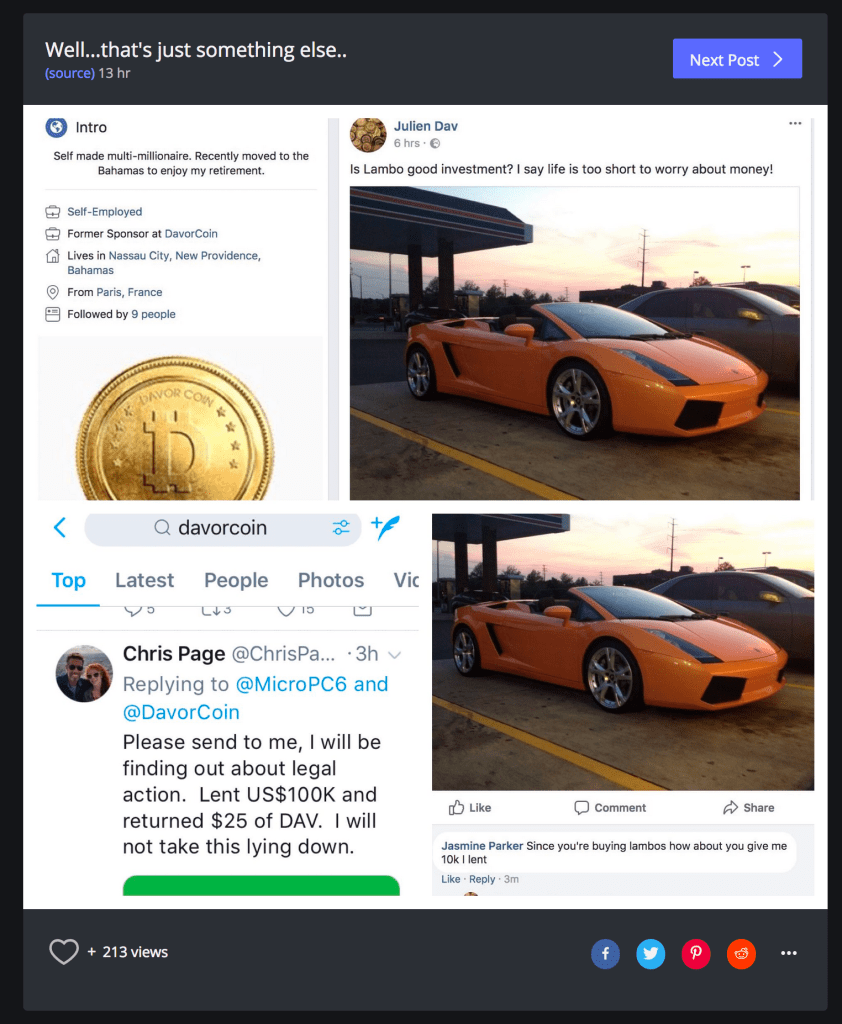

After releasing the loan packages on February 7, 2018, the user received his 290.93 Davor Coins back, but at a price of just 4 cents. His previously paid in Bitcoin and then exchanged in Davor 43,000 US dollars were thus only 11.63 US dollars worth. The customer sees this as pure fraud and indeed in several respects, since none of the promises and painted on the wall great interest rates were met and filed a complaint with the criminal police with a focus on cybercrime in Karlsruhe.

The money he can now pay off only in Bitcoin, whereby a transfer fee of 20 US dollars is incurred. His entire investment thus remains permanently on the platform. Almost all investors lose their investment to 100 percent. This is particularly extravagant as DavorCoin had promised that investors would get back plus interest at the end of their paid-in money, which could also be termed a loan to Davor.

While Davor operators claim they could not do anything for the disaster and the sharp fall in prices, the cheated investors suspect: The course may also have been deliberately driven down to pull millions out of the system and not have to pay anything. Accordingly, numerous lawsuits against Davor Coin are already running, steuerratschlag.eu knows.

Mockery and ridicule for the investors

Mockingly, the Davor Coin team writes in their email that there are both winners and losers in this project. One thing is clear: the big winner can only be in front of it. After all, the platform was only two months after the initial coin offering in November as a trading platform. That means: The rental option was a good two months. Even for early investors, this did not leave enough time to draw their capital out of the interest. Especially not when you get in mid-January – at a time when DavorCoin had an average trading volume of between $ 1 million and over $ 6 million daily.

Adding up the daily trading volume, the platform could have turned over well over $ 300 million into Bitcoin since its launch in November 2017, as Bitcoin was the only cryptocurrency the platform offered in exchange for DavorCoin. How much bitcoin the operators withdrew from the platform remains unclear. Given the dramatic losses of sometimes 99.96 percent, the backers could have captured an amount of at least 100 million US dollars. Money that investors now lack. But it is also possible damage of well over 300 million euros. „Just in a period of the last two weeks of January 2018, according to my observation, between 6 and 8 million dollars were spent daily,“ says one victim.

The disdain and arrogance of the Davor Coin team towards its investors reappear in the last sentence of their e-mail. In there, the operator promises that there are many new and exciting projects in the pipeline and that Davor Coin will have a “bright future” [6]. For investors who lost all their capital within two weeks, that’s a slap in the face.

Police investigation

That the platform accepted only Bitcoin as a means of payment, could be the backers to fatal. After all, every single transaction in the blockchain is recorded to prevent tampering or fraud.

As a first step, police authorities could track individual transfers and evaluate cash flows. In the meantime, researchers have even managed to get the IP addresses of the respective users with a probability of up to 60 percent. So for the rip-off investors, there is still hope that the fraudsters will get on the wrong track. [9]

Finally, the question arises, of course, how it came to this large-scale fraud. While the American authorities are already investigating lending platforms such as Bitconnect and Davor Coin and warning consumers, BaFin does not care about what happens to citizens‘ hard-earned money.

Although the German state wants to earn a lot from the crypto-boom, it does nothing to protect consumers. Here, there is an urgent need to catch up on the part of the legislator, especially with regard to the approval of crypto-coins in Germany. Because despite the many dubious crypto providers, there are at least as many reputable. Now the chaff must be separated from wheat.

United Emirates Coin, UEC – the next possible scam system is already in the starting blocks

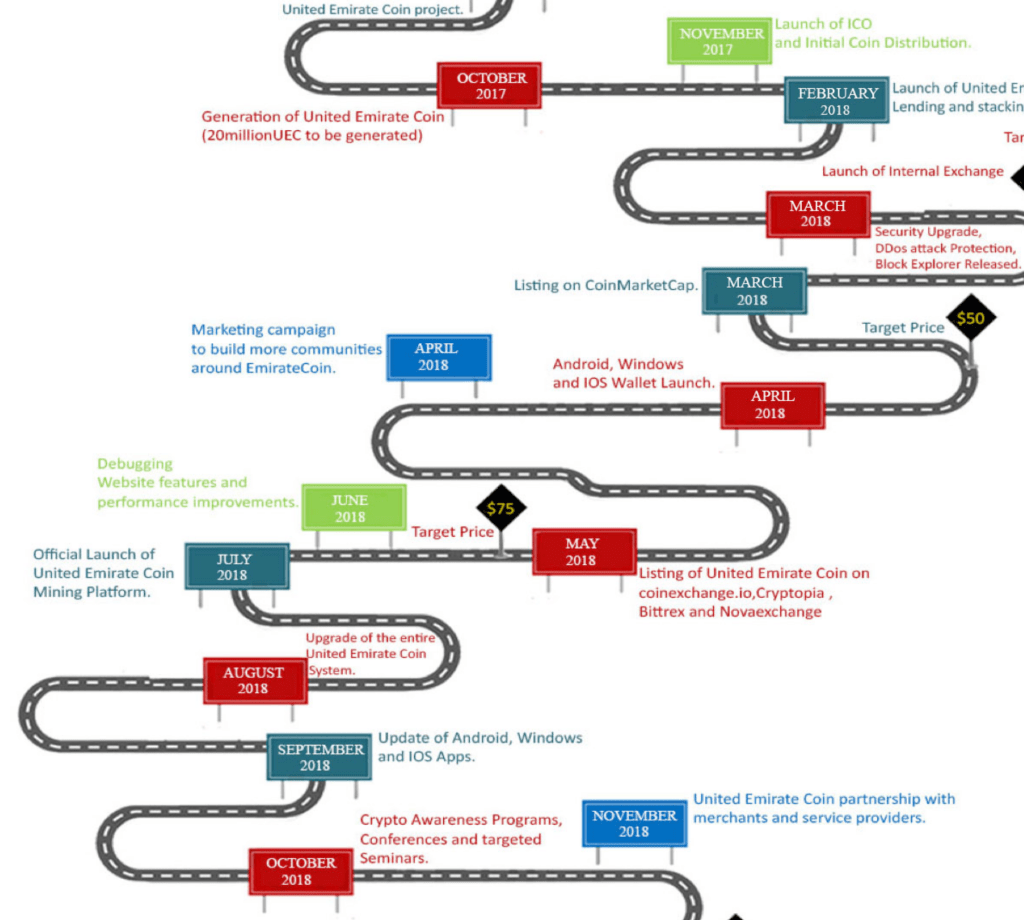

But another project is at the start, which sounds quite similar dubious as the Davor Coin: The United Emirates Coin, which is accessible via unitedemiratecoin.io.

steuerratschlag.eu but suspects a fraud system behind it. Reason: The system is almost identical to the DavorCoin. So go away!

A German invested on the recommendation of a colleague who meant well, there 2000 €, so 2500 US dollars and that, as with the DavorCoin, with the currency Bitcoin. The corresponding Bitcoin shares he had transmitted from his German bitcoin.de account using a number and character codes to the landing page of the United Emirates Coin. But now he cannot reach his money anymore. Reason:

The two-way verification of his account is blocked. On mails, the initiators of the alleged UCE Coins have never responded. So are you already grabbing the next 100 or 300 million euros?

We warn explicitly: keep your fingers off of platforms that promise an astronomical return on coins from the outset! Especially if they end with „io“ in the domain. This is a special encryption technique that is supposed to prevent authorities from coming to grips with the criminals.

Do not be fooled by those graphics that promise growth in any dubious whitepapers or on homepages. Exception: Only if, for example, an official license exists or, for example, a German verifiable company is involved in an ICO can one possibly be confident that this is not a fraud coin.

So now it’s time not to condemn the entire scene, but to look more critically at the business model before investing in cryptocurrencies.

Charts for DavorCoin are available here: coinmarketcap.com/currencies/davorcoin/

194

194